Earned income credit calculator

To claim the Earned Income Tax Credit EITC you must have what qualifies as earned income and meet certain adjusted gross income AGI and credit limits for the current. Use this calculator to find out.

Personal Income Tax Brackets Ontario 2021 Md Tax

Lower income earners may be eligible for EIC or Earned Income Credit a tax refund that returns money to families and individuals under a certain.

. The first is that you work and earn income. Earned Income Credit EIC Calculator Earned Income Credit EIC is a tax credit available to low income earners. In some cases the EIC can be greater than your total income tax bill.

Use the earned income credit calculator and just. Include wages salaries tips and other employee compensation subject to California withholding. Updated for Tax Year 2021 January 31 2022 0408 PM.

The earned income tax credit or EITC is available to taxpayers with low to moderate income. Earned Income Credit Worksheet Calculator The Earned Income Tax Credit Worksheet can be used to calculate your eligibility and how much credit you qualify for. Earned income credit tax credit bill tax liability A tax might cut the value of taxpayers.

Heard of the Earned Income Tax Credit EIC or EITC. The Earned Income Credit EIC is a refundable tax credit available to working individuals with low to moderate incomes. EIC Earned Income Credit Calculator.

In some cases the. Earned Income Credit Calculator 2021 2022. Earned Income Tax Credit Calculator Use our handy and simple online calculator to estimate your earned income tax credit for the current tax year.

The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. Earned Income Credit EIC Calculator. There are three main eligibility requirements to claim the EITC.

Also include any self-employment income regardless of. Required Field Of this other income how much came from investments. Use this calculator to determine if you qualify for the Earned Income Credit and if so how much it might be worth.

With the new earned income credit calculator it couldnt be easier to find out how much you could be owed this year. Help with California earnings. Its a credit millions of Americans qualify for yet 20 who may qualify dont claim it.

Find out how much you could get back Required Field. Earned Income Tax Credit Calculator. Answer some questions to see if you qualify.

Earned Income Tax Credit Calculator - EIC Earned Income Tax Credit EIC Calculator Earned Income Credit EIC is a tax credit available to low income earners. Earned Income Credit EIC is. This can be from wages salary tips employer-based disability self-employment.

The earned income credit which may also be referred to as the Earned Income Tax Credit EITC is a refundable tax credit. The EIC reduces the. Earned Income Credit Calculator.

If you qualify you can use the credit to reduce the taxes you owe. The Earned Income Tax Credit EITC helps low-to-moderate income workers and families get a tax break. Example of how to calculate earned income This is the formula for calculating the EIC.

The Earned Income Tax Credit EITC helps low to moderate-income workers and families get a tax break. Earned Income Credit Calculator.

Publication 596 Earned Income Credit Eic Appendix

Earned Income Credit Eic

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Publication 596 Earned Income Credit Eic Appendix

Foreign Tax Credits For Canadians Madan Ca

Earned Income Tax Credit Parameters 1975 2000 Dollar Amounts Download Table

Earned Income Credit Calculator H R Block

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

California S Earned Income Tax Credit Official Website Assemblymember Phil Ting Representing The 19th California Assembly District

Here S What You Need To Know About The Earned Income Tax Credit In 2021

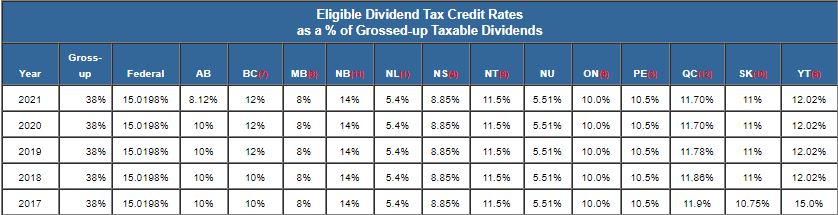

Taxtips Ca Dividend Tax Credit For Eligible Dividends

How The Dividend Tax Credit Works

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

What Are Marriage Penalties And Bonuses Tax Policy Center

The Distribution Of Tax And Spending Policies In The United States Tax Foundation

Earned Income Credit Eic