Federal tax estimator 2020

Up to 10 cash back Your tax bracket shows you the tax rate that you will pay for each portion of your income. It is mainly intended for residents of the US.

Personal Income Tax Slab For Fy 2020 21 Income Tax Income Tax Return Income

Prepare File Prior Year Taxes Fast.

. See January payment in Chapter 2 of Publication 505 Tax Withholding and Estimated Tax. Enter your filing status income deductions and credits and we will estimate your total taxes. As the leader in tax preparation more federal.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Figure out the amount of taxes you owe or your refund using our 2020 Tax Calculator. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

US Tax Calculator 2020. You can use the Tax Withholding Estimator to estimate your 2020 income tax. Its never been easier to calculate how much you may get back or owe with our tax estimator tool.

Americas 1 tax preparation provider. IRS YouTube Videos. Fill out some basic information like.

Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. For example if you are a single person the lowest possible tax rate of 10. Fill out some personal information.

January 15 of the following year. Prepare and File Your 2020 Federal Taxes with Simple Step-by-step Guidance. Based on your projected tax withholding for the year we can also estimate your tax refund or.

Use your income filing status deductions credits to accurately estimate the taxes. Enter your filing status income deductions and credits and we will estimate your total taxes for tax year 2020. Ad With TurboTax Its Fast And Easy To Get Your Taxes Done Right.

The Tax Withholding Estimator compares that estimate to your current tax withholding and can. WASHINGTON The Internal Revenue Service has launched a. Estimate your tax refund with HR Blocks free income tax calculator.

Based on your projected tax withholding for the year we can also estimate your. Updated to include income tax calculations for 2021 form 1040 and 2022 Estimated form 1040-ES for status Single Married Filing Jointly Married Filing Separately or. Your household income location filing status and number of personal.

Have the full list of required tax documents ready. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

September 1 December 31. Dont Put It Off Any Longer. 1 best-selling tax software.

Likewise pursuant to Notice. IRS Tax Withholding Estimator English Spanish obsolete IR-2020-09 January 14 2020. And is based on the tax brackets of 2021.

Your household income location filing status and number of personal. 16 hours agoFederal student loan borrowers who earned less than 125000 in either the 2020 or 2021 tax years are eligible. Based on aggregated sales data for all tax year 2020 TurboTax products.

Get Previous Years Taxes Done Today With TurboTax. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. This page includes the United States Annual Tax Calculator for 2020 and supporting tax guides which are designed to help you get the most out of the tax calculator and.

Ad Always Free Federal Always Simple Always Right. For those who filed taxes jointly or as a head of household the. Including a W-2 and any relevant investment or property documents.

Pursuant to Notice 2020-18 PDF the due date for your first estimated tax payment was automatically postponed from April 15 2020 to July 15 2020.

Irs Releases Second Draft Of 2020 Form W 4 Tax Withholding Estimator Check Out The Latest Updates To 2020 Form W 4 The Irs I Irs Federal Income Tax Draught

How To Calculate Federal Income Tax

Income Tax Mini Ready Reckoner 21e Income Tax Income Investing

Hmrc Sa302 Tax Calculation Templates Document Templates Bills

Irs Just Released New 2020 Form W 4 Employee S Withholding Certificate Today Which Is The Form For You To Request How Much M Online Taxes Tax Refund Irs Taxes

Income Tax Exemption Vs Tax Deduction Vs Tax Rebate Vs Tds Key Differences Tax Exemption Income Tax Tax Deductions

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

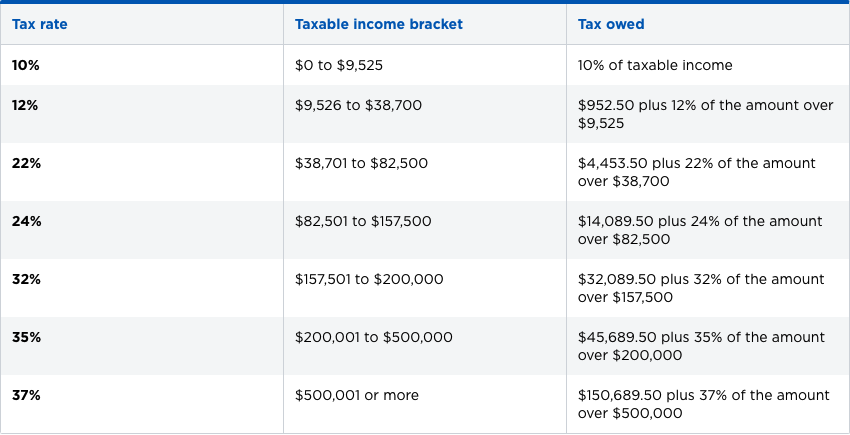

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Federal Income Tax Brackets Brilliant Tax

Free Income Tax Efiling In India Cleartax Upload Your Form 16 To E File Income Tax Returns Filing Taxes Tax Refund Income Tax Return

How To Fill Out The W 4 Form New For 2020 Smartasset Federal Income Tax Form Income Tax

How To Calculate Federal Income Tax

Tax Refund Estimator Calculator For 2021 Return In 2022

Income Tax Calculation Fy 2019 20 Salaried Employees Standard Deduction Rebate U S 87a Cess Youtube Standard Deduction Income Tax Income

Income Tax Income Tax Income Tax

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet